The Henry George School of Social Science, and the New School of Social Research invite you to follow Professor Anwar M. Shaikh in a new series of lectures exploring his new ground-breaking Economic treatise, “Capitalism: Competition, Conflict and Crises”. The course will be introduced over two semesters. Recordings of the first semester, becoming available now, is comprised of 15 lectures. Subscribe to our YouTube Channel, Henry George School of Social Science to receive updates as new lectures are added.

The Henry George School of Social Science, and the New School of Social Research invite you to follow Professor Anwar M. Shaikh in a new series of lectures exploring his new ground-breaking Economic treatise, “Capitalism: Competition, Conflict and Crises”. The course will be introduced over two semesters. Recordings of the first semester, becoming available now, is comprised of 15 lectures. Subscribe to our YouTube Channel, Henry George School of Social Science to receive updates as new lectures are added.

Competition and conflict are intrinsic features of modern societies, inequality is persistent, and booms and busts are recurrent outcomes throughout capitalist history. State intervention modifies these patterns, but does not abolish them.

Professor Shaikh exposes how these and many other observed patterns are the results of intrinsic forces that shape and channel outcomes. Social and institutional factors play an important role, but at the same time, the factors are themselves limited by the dominant forces arising from “gain-seeking” behavior, of which the profit motive is the most important. These dominant elements create an invisible force field that shapes and channels capitalist outcomes.

The book’s approach departs from that of orthodox economics as well as the dominant elements in the heterodox tradition. There is no reference whatsoever to an idealized framework rooted in perfect firms, perfect individuals, perfect knowledge, perfectly selfish behavior, rational expectations, or so-called optimal outcomes. The book develops microeconomic and macroeconomic theory from real behavior and real competition, and uses it to explain empirical patterns in microeconomic demand and supply, wage and profits, technological change, relative prices of goods and services, interest rates, bond and equity prices, exchange rates, patterns of international trade, growth, unemployment, inflation, national and personal inequality, and the recurrence of general crises such as the current one which began in 2007-2008.

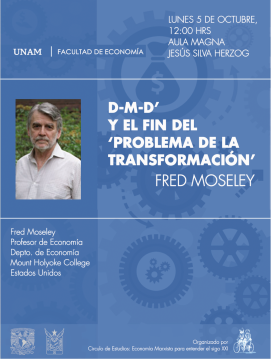

Fred Moseley acaba de publicar un importante libro, Money and Totality. A Macro-Monetary Interpretation of Marx’s Logic in Capital and the End of the “Transformation Problem”, (Leiden, Brill, Historical Materialism Book Series). El libro ha sido editado en tapa dura por Brill (

Fred Moseley acaba de publicar un importante libro, Money and Totality. A Macro-Monetary Interpretation of Marx’s Logic in Capital and the End of the “Transformation Problem”, (Leiden, Brill, Historical Materialism Book Series). El libro ha sido editado en tapa dura por Brill ( I have started reading Heinrich’s ‘An Introduction to the Three Volumes of Karl Marx’s Capital’. I decided to read it after I was told that this was probably the most influential work published by what are termed the ‘value form’ theorists. Up until this point I had known of Heinrich only by his participation on the OPE-L mailing list, a list for people interested in Marxian political economy.

I have started reading Heinrich’s ‘An Introduction to the Three Volumes of Karl Marx’s Capital’. I decided to read it after I was told that this was probably the most influential work published by what are termed the ‘value form’ theorists. Up until this point I had known of Heinrich only by his participation on the OPE-L mailing list, a list for people interested in Marxian political economy. Resumen

Resumen Gracias a los esfuerzos de marxistas a lo largo de todo el mundo, progresivamente tenemos a nuestra disposición, más obras de Marx traducidas en diferentes idiomas para su consulta. Recientemente, gracias a la editorial Brill y a la Revista

Gracias a los esfuerzos de marxistas a lo largo de todo el mundo, progresivamente tenemos a nuestra disposición, más obras de Marx traducidas en diferentes idiomas para su consulta. Recientemente, gracias a la editorial Brill y a la Revista  Resumen

Resumen

Este artículo pretende mostrar que el concepto de valor intrínseco –valor como distinto de valor de cambio– se convirtió en un elemento importante de la crítica de la economía política realizada por Karl Marx

Este artículo pretende mostrar que el concepto de valor intrínseco –valor como distinto de valor de cambio– se convirtió en un elemento importante de la crítica de la economía política realizada por Karl Marx Resumen: La razón principal por la que se ha rechazado la teoría de Marx durante el último siglo ha sido el infame ‘problema de la transformación’. Los críticos argumentan que Marx, en su teoría de los precios de producción ‘falló en transformar los valores’ de los insumos de capital constante y capital variable a precios de producción y por consiguiente la teoría de Marx está incompleta y es inconsistente en términos lógicos. Este trabajo argumenta que Marx no falló en ‘transformar los valores de los insumos’ porque no se supone que los insumos de capital constante y capital variable sean transformados. Al contrario, se supone que el capital constante y el capital variablepermanecen iguales en la determinación tanto de los valores como de los precios de producción – las cantidades reales de capital-dinero adelantado para comprar los medios de producción y la fuerza de trabajo al principio del circuito de capital dinero (D – M – D’) que son tomados como dados – y por consiguiente la teoría de los precios de Marx está completa y es lógicamente coherente. Se presenta un resumen algebraico de esta interpretación “monetaria” de la teoría de Marx en la Sección 3, así como ejemplos de la evidencia textual que apoyan esta interpretación “monetaria” en la Sección 4.

Resumen: La razón principal por la que se ha rechazado la teoría de Marx durante el último siglo ha sido el infame ‘problema de la transformación’. Los críticos argumentan que Marx, en su teoría de los precios de producción ‘falló en transformar los valores’ de los insumos de capital constante y capital variable a precios de producción y por consiguiente la teoría de Marx está incompleta y es inconsistente en términos lógicos. Este trabajo argumenta que Marx no falló en ‘transformar los valores de los insumos’ porque no se supone que los insumos de capital constante y capital variable sean transformados. Al contrario, se supone que el capital constante y el capital variablepermanecen iguales en la determinación tanto de los valores como de los precios de producción – las cantidades reales de capital-dinero adelantado para comprar los medios de producción y la fuerza de trabajo al principio del circuito de capital dinero (D – M – D’) que son tomados como dados – y por consiguiente la teoría de los precios de Marx está completa y es lógicamente coherente. Se presenta un resumen algebraico de esta interpretación “monetaria” de la teoría de Marx en la Sección 3, así como ejemplos de la evidencia textual que apoyan esta interpretación “monetaria” en la Sección 4.  The objective of the following observations is to offer a rough overview of central ways of reading Marx’s theory. These are to be presented – by means of a few selected topics – as Marxisms that can be relatively clearly delimited from one another, and the history of their reception and influence will be evaluated with regard to the common-sense understanding of “Marxist theory.”

The objective of the following observations is to offer a rough overview of central ways of reading Marx’s theory. These are to be presented – by means of a few selected topics – as Marxisms that can be relatively clearly delimited from one another, and the history of their reception and influence will be evaluated with regard to the common-sense understanding of “Marxist theory.”

Existen dos vertientes generales dentro de la teoría económica marxista por la manera en que determinan los conceptos más relevantes (el valor, los precios, la tasa de ganancia, etc.): la simultaneista y la temporalista.

Existen dos vertientes generales dentro de la teoría económica marxista por la manera en que determinan los conceptos más relevantes (el valor, los precios, la tasa de ganancia, etc.): la simultaneista y la temporalista.