Archivo

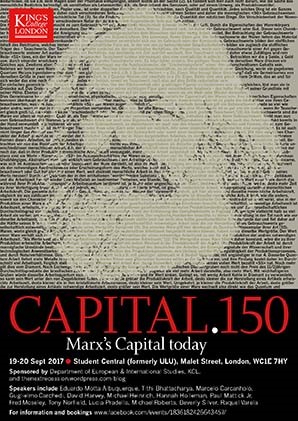

«Perspectives from the Circulation of Capital. Perspectives from the Accumulation of Capital»: David Harvey, Michael Roberts.

Reseña de “Rentabilidad, inversión y crisis” de José Tapia: Rolando Astarita

Ediciones Maia acaba de publicar Rentabilidad, inversión y crisis. Teorías económicas y datos empíricos (Madrid, 2017), de José Tapia. Actualmente Tapia es profesor titular de la Universidad Drexel, en Filadelfia, donde dicta cursos sobre desarrollo social, Economía Política y cambio climático. Ha publicado en revistas académicas internacionales, y juntos escribimos La Gran Recesión y el capitalismo del siglo XXI (Catarata, 2011). También estuvo a cargo de la edición de Crisis económica y teorías de la crisis: un ensayo sobre Marx y la “ciencia económica”, de Paul Mattick.

Ediciones Maia acaba de publicar Rentabilidad, inversión y crisis. Teorías económicas y datos empíricos (Madrid, 2017), de José Tapia. Actualmente Tapia es profesor titular de la Universidad Drexel, en Filadelfia, donde dicta cursos sobre desarrollo social, Economía Política y cambio climático. Ha publicado en revistas académicas internacionales, y juntos escribimos La Gran Recesión y el capitalismo del siglo XXI (Catarata, 2011). También estuvo a cargo de la edición de Crisis económica y teorías de la crisis: un ensayo sobre Marx y la “ciencia económica”, de Paul Mattick.

Rentabilidad, inversión y crisis representa una muy importante contribución al estudio de la acumulación y crisis capitalistas. En particular porque examina la validez de diferentes teorías sobre el ciclo económico a la luz de la evidencia empírica. Con la esperanza de que Rentabilidad… pueda llegar a América Latina, en lo que sigue resumo sus ideas principales, y animo a los lectores del blog a estudiarlo.

Ni crecimiento permanente, ni estancamiento permanente, sino ciclos

Tapia parte de que la teoría de la crisis y la teoría del ciclo son la misma cosa, y que términos como recesión, crisis o depresión se refieren al mismo fenómeno. Es un enfoque que toma distancia de la idea, muy extendida entre marxistas y gente de izquierda, de que en el capitalismo existen períodos largos, de décadas incluso, de depresión. Por ejemplo, la tesis de los ciclos Kondratiev dice que existen ondas largas de unos 50 años de duración –con unos 25 años de ascenso y 25 de estancamiento o retroceso. Otros enfoques hablan de estancamiento crónico, a veces desde 1914, otras desde los 1970. Una idea que fue adelantada originariamente por Engels, cuando afirmó, en 1886, que el capitalismo había entrado en estancamiento permanente. En oposición a estos enfoques, Tapia sostiene que los datos no avalan la existencia de las ondas largas Kondratiev, ni el estancamiento crónico. Las economías capitalistas se caracterizan por los ciclos económicos, esto es, por las fases de expansión y de recesión, que se repiten a lo largo de toda su historia. Lo que hay que explicar entonces es esta dinámica característica del modo de producción capitalista. Leer más…

«¿El capitalismo se ha encontrado con límites infranqueables?»: François Chesnais

La revista Inprecor n° 631/632, noviembre de 2016, tradujo del español e incluyó un artículo anteriormente publicado en Herramienta;icuyo texto original estaba en inglés, pues era la conclusión de un libro sobre el capital financiero y la finanza escrito a la luz de la crisis del 2007-2008 y las transformaciones en las formas mundializada de explotación de las mujeres y hombres proletarizados.ii Tanto la conclusión del libro como el artículo adoptan como horizonte la perspectiva de una sociedad humana. Las observaciones de amigos que lo leyeron me convencieron de que es necesario aclarar algunos argumentos. Además, no pocos acontecimientos políticos de los últimos meses invitan a “aproximar” el horizonte de la reflexión.

Desde hace dos o tres años, se han publicado muchos ensayos sobre las tensiones políticas mundiales, domésticas e internacionales, así como sobre los malestares sociales franceses y europeos. No son pocos los autores que relacionan tales cuestiones con el neoliberalismo, con la “globalización” y con sus consecuencias. Acá, se las relaciona con el curso del capitalismo y con su impasse. De los acontecimientos a nivel de la “superestructura”, mi texto pasa a la “infraestructura”, al movimiento de acumulación de capital en el largo plazo y a las barreras con que se encuentra. Y la perspectiva que se avizora es una situación en donde las consecuencias políticas y sociales del débil crecimiento y la endémica inestabilidad financiera, junto con el caos político que generan (ya mismo en algunas partes del mundo, potencialmente en otras) tienden a converger con el impacto social y político del cambio climático. Leer más…

«A New “General Theory”? A review of «Capitalism» by Anwar Shaikh»: Bernard Guerrien

“The goal of this book is to develop a theoretical structure that is appropriate from the very start to the actual operations of existing developed capitalist countries. Its object of investigation is neither the perfect, nor the imperfect, but rather the real. For this reason, the theoretical arguments developed here, along with their main alternatives, are constantly confronted with empirical evidence” (p. 4).

“The goal of this book is to develop a theoretical structure that is appropriate from the very start to the actual operations of existing developed capitalist countries. Its object of investigation is neither the perfect, nor the imperfect, but rather the real. For this reason, the theoretical arguments developed here, along with their main alternatives, are constantly confronted with empirical evidence” (p. 4).“Finance Capital Today de François Chesnais”: reseña de Louis Gill

François Chenais es conocido por su importante aportación, de más de cuarenta años, al análisis del capitalismo contemporáneo y de sus crisis económicas y financieras. El economista francés acaba de publicar en la colección “Historical Materialism Book Series” (Ed. Brill, Leiden y Boston) un libro titulado Finance Capital Today. Corporations and Banks in the Lasting Global Slump. Este libro es una excelente síntesis de la amplia reflexión realizada sobre la cuestión del capital financiero y sobre su propio trabajo. Recordemos al respecto algunas de las contribuciones de Chesnais, bajo la forma de 1) monográficos (La mondialisation du capital, Syros, 1994 y 1997, Les dettes illégitimes, Raisons d’agir, 2011); 2) de dirección o codirección de obras colectivas (La mondialisation financière, Syros, 1996, Les pièges de la finance mondiale, con Dominique Plihon, La Découverte-Syros, 2000); 3) conferencias y presentaciones en seminarios y simposios; 4) artículos publicados en revistas, entre ellas La Vérité, Actuel Marx, Contretemps, La Brèche y Carré Rouge, de la cual fue uno de sus fundadores en 1995 y el principal animador hasta su desaparición en 2013.

François Chenais es conocido por su importante aportación, de más de cuarenta años, al análisis del capitalismo contemporáneo y de sus crisis económicas y financieras. El economista francés acaba de publicar en la colección “Historical Materialism Book Series” (Ed. Brill, Leiden y Boston) un libro titulado Finance Capital Today. Corporations and Banks in the Lasting Global Slump. Este libro es una excelente síntesis de la amplia reflexión realizada sobre la cuestión del capital financiero y sobre su propio trabajo. Recordemos al respecto algunas de las contribuciones de Chesnais, bajo la forma de 1) monográficos (La mondialisation du capital, Syros, 1994 y 1997, Les dettes illégitimes, Raisons d’agir, 2011); 2) de dirección o codirección de obras colectivas (La mondialisation financière, Syros, 1996, Les pièges de la finance mondiale, con Dominique Plihon, La Découverte-Syros, 2000); 3) conferencias y presentaciones en seminarios y simposios; 4) artículos publicados en revistas, entre ellas La Vérité, Actuel Marx, Contretemps, La Brèche y Carré Rouge, de la cual fue uno de sus fundadores en 1995 y el principal animador hasta su desaparición en 2013.

Este libro, escribe Chesnais, se interesa por dos dimensiones, distintas pero interrelacionadas, de la economía mundial contemporánea. La primera consiste en las formas y consecuencias de la interpenetración de los grandes bancos y de las sociedades industriales, comerciales y de servicios, habiendo alcanzado un nivel muy elevado de concentración e internacionalización, algo que constituye la forma contemporánea de lo que el marxista austríaco Rudolf Hilferding designaba como el “capital monetario” en su obra de 1910 Das Finanzkapital. La segunda consiste en lo que Chesnais define como “las finanzas en tanto que finanzas” (en inglés finance qua finance), para representar el proceso asociado al crecimiento espectacular, en el curso de los últimos cuarenta años, de los activos (acciones, obligaciones y derivados) en posesión de las sociedades financieras (bancos y fondos), pero también de los departamentos financieros de las sociedades industriales y comerciales transnacionales. A este capital Chesnais lo designa como “capital financiero” para distinguirlo del “capital monetario” en el sentido que le daba Hilferding. Su análisis procede de las categorías de “capital productor de interés” y de “capital ficticio” enunciadas por Karl Marx en la Sección V del Libro III de El Capital. Chesnais es, dicho sea de paso, en gran parte responsable de haber arrojado luz sobre esta dimensión fundamental del análisis de Marx, en un artículo de 1979 titulado “Capital financier et groupes financiers : recherche sur l’origine des concepts et leur utilisation actuelle en France”, publicado en 1981 en un libro colectivo bajo la dirección de Charles-Albert Michalet [1]. A partir de ahí, se ha apoyado repetidamente sobre estos elementos clave del análisis de Marx en sus numerosos escritos. Leer más…

«Visualizing Capital»: David Harvey

In January, David Harvey spoke at the School of Geography and the Environment, Oxford to present «Visualizing Capital»: what he «hopes is the end» of the project on Marx he began — inadvertantly — fifteen years ago.

In January, David Harvey spoke at the School of Geography and the Environment, Oxford to present «Visualizing Capital»: what he «hopes is the end» of the project on Marx he began — inadvertantly — fifteen years ago.

«Most commentators on Marx have the habit of trying to make Marx more complicated than he already is,» Harvey says, «we should be concerned with trying to make simple representations of Marx without being simplistic.» Leer más…

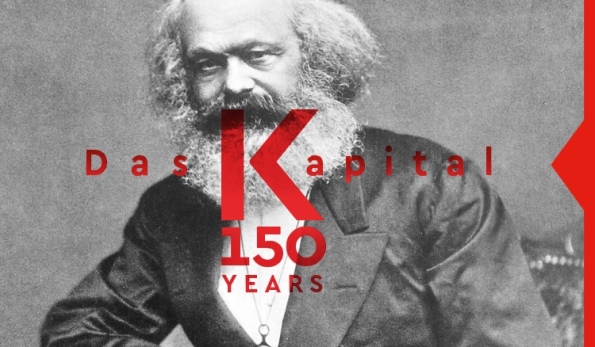

«150 years Karl Marx’s Capital»: John Milios, Michael Heinrich, Michael Lebowitz, Etienne Balibar, Marta Harnecker, Panagiotis Sotiris…

INTERNATIONAL CONFERENCE

150 years Karl Marx’s “Capital” – Reflections for the 21st century

14-15.1.2017 | Athens – Greece

To commemorate in 2017 the 150th anniversary of Volume 1 of Capital, Rosa Luxemburg Stiftung – Athens Office in cooperation with Theseis are organizing a two-days international conference in Athens, on the actuality of Marx’s theoretical system of the critique of political economy.

Karl Marx’s major work, Capital, is broadly recognized as an indispensable point of departure for all those who are interested in deciphering and analyzing in depth the inner workings of capitalism. The system of concepts and analyses in Marx’s Capital provides radical thinkers with insights to demystify the “truths” of the dominant bourgeois theoretical schemes, ideological certainties and policy implications. It is thus of great theoretical and political importance. Marx’s “critique of political economy” in Capital and in the relevant manuscripts of the period 1857-1867 forms a unique theoretical terrain, which enables the understanding of economic and social power relations, their driving forces and evolution trends, in all societies where the capitalist mode of production is dominant. Capital remains relevant and powerful. It is particularly timely in the midst of the present systemic global economic crisis.

«Harvey contra Marx sobre las crisis del capitalismo, segunda parte: malinterpretando la rentabilidad»: Andrew Kliman

Este artículo es la segunda parte de una crítica de Andrew Kliman a un borrador de un artículo de David Harvey, publicado en el tristemente difunto New Left Project. En la primera parte de la crítica hice una pequeña introducción a la polémica que subyace a este intercambio. En las próximas semanas publicaremos la respuesta de Harvey a Kliman y la contrarréplica de éste. Aprovecho para agradecer a Pau Llonch y a Antonio Dorado su revisión de la primera y segunda parte de la crítica.

Este artículo es la segunda parte de una crítica de Andrew Kliman a un borrador de un artículo de David Harvey, publicado en el tristemente difunto New Left Project. En la primera parte de la crítica hice una pequeña introducción a la polémica que subyace a este intercambio. En las próximas semanas publicaremos la respuesta de Harvey a Kliman y la contrarréplica de éste. Aprovecho para agradecer a Pau Llonch y a Antonio Dorado su revisión de la primera y segunda parte de la crítica.

Las pruebas son claras: desde el final de la Segunda Guerra Mundial hasta la Gran Recesión, la tasa de ganancia total de las corporaciones estadounidenses descendió, y este descenso se explica casi en su totalidad gracias a la Ley del Descenso Tendencial de la Tasa de Ganancia de Marx

La primera parte de este artículo se centró en la interpretación de David Harvey (Harvey 2014) de la Ley del Descenso Tendencial de la Tasa de Ganancia (LDTTG) de Marx, a medida que la producción capitalista se incrementa – una ley que Marx identificó como “la ley más importante de la economía política”. Resta por tratar la creencia de Harvey de que la LDTTG no ha operado desde los años 80.

Los datos de mano de obra que se trataron en la primera parte constituyen la única “prueba” de Harvey de que la LDTTG no ha actuado; no presenta pruebas directas al respecto de la tasa de ganancia (esto es: la cantidad de ganancia como porcentaje del volumen de capital invertido). Sin embargo, pone en tela de juicio las pruebas que hemos presentado tanto yo como otros que indican que la tasa de ganancia descendió realmente a lo largo de los años 80 y 90 (ver Figura 1) [1]. Leer más…

«Harvey contra Marx sobre las crisis del capitalismo, primera parte: malinterpretando a Marx»: Andrew Kliman

El siguiente texto es una crítica de Andrew Kliman, profesor emérito de Economía, a un borrador preparado por David Harvey para un congreso en Turquía y que según tengo entendido era la base para un capítulo que posteriormente este autor ha contribuido al libro The Great Financial Meltdown: Systemic, Conjuntural or Policy Created?, editado por Turan Subasat.

El siguiente texto es una crítica de Andrew Kliman, profesor emérito de Economía, a un borrador preparado por David Harvey para un congreso en Turquía y que según tengo entendido era la base para un capítulo que posteriormente este autor ha contribuido al libro The Great Financial Meltdown: Systemic, Conjuntural or Policy Created?, editado por Turan Subasat.

Si Harvey es conocido entre la izquierda (tanto activista como académica) por su empeño en divulgar y dar a conocer El Capital de Marx gracias a su curso online sobre el mismo, Kliman se ha centrado más en, refutar interpretaciones erróneas de Marx que se han hecho, no sólo desde el ámbito neoclásico de la economía, sino también desde posiciones keynesianas, sraffianas e incluso dentro de la propia economía marxiana. Así, Kliman es defensor, junto a Alan Freeman y otros autores, de una interpretación concreta de la teoría del valor de Marx, la TSSI (por Temporal Single System Interpretation, o Interpretación de Sistema Único y Temporal), que aplicada a la obra del alemán, serviría según ellos para que la supuestas incoherencias internas de la misma se evaporasen. Así, las críticas de Piero Sraffa, Ladislaus Bortkiewicz, o Nobuo Okishio, simplemente carecerían de fundamento al dirigirse contra una malinterpretación de lo que Marx decía. Leer más…

«El capital ficticio y la crisis actual»: Marcelo Dias Carcanholo

En el tercer tomo de El Capital, Marx esboza la categoría de capital ficticio, una forma de capital que hoy día crece ante la necesidad de construir nuevos espacios de valorización para el capital sobreacumulado. En contraposición con la categoría capital financiero, Marcelo Carcanholo propone capital ficticio como categoría central para entender la crisis del capitalismo actual. Leer más…

En el tercer tomo de El Capital, Marx esboza la categoría de capital ficticio, una forma de capital que hoy día crece ante la necesidad de construir nuevos espacios de valorización para el capital sobreacumulado. En contraposición con la categoría capital financiero, Marcelo Carcanholo propone capital ficticio como categoría central para entender la crisis del capitalismo actual. Leer más…

«La Larga Depresión»: Entrevista a Michael Roberts

MK: Nuestro gobierno asegura que la economía se recupera. Al mismo tiempo, vemos que Grecia necesita de forma continua “paquetes de rescate” y ahora hay problemas en Italia. ¿Cuál es el estado de la economía mundial?

MK: Nuestro gobierno asegura que la economía se recupera. Al mismo tiempo, vemos que Grecia necesita de forma continua “paquetes de rescate” y ahora hay problemas en Italia. ¿Cuál es el estado de la economía mundial?

MR: El desarrollo de la economía mundial desde 1945 no ha sido armonioso, no ha crecido en línea recta. Ha habido una serie de auges y recesiones. Me refiero a una disminución del ingreso nacional o la producción nacional de un país por lo menos durante seis meses o más, antes de volver a recuperarse y crecer.

Pero lo específico de este último periodo, es que tuvimos una gran caída en 2008-9 después de la crisis financiera internacional. La Gran Recesión, que duró 18 meses, fue la mayor desde la década de 1930. Como resultado, todas las grandes economías del mundo, entre ellas la de los Países Bajos, experimentaron una fuerte disminución de su renta y producción nacional. Cada vez que sucede, millones de personas ven sus vidas arruinadas, pierden sus puestos de trabajo y, posiblemente, sus casas, porque no pueden pagar el alquiler o la hipoteca. Además, los gobiernos aplican toda una serie de medidas, de recortes en el estado de bienestar y en los servicios públicos, que afectan a la población también. Además, todo ese período de declive es una pérdida permanente. Si no hubiera habido caída, la producción y los ingresos habría sido mayores, el volumen y la calidad del empleo hubiera sido mejor. Eso nunca se puede recuperar. Leer más…

«The decline of the rate of profit in the postwar US economy: A comment on Brenner»: Fred Moseley

The publication of Robert Brenner’s «The Economics of Global Turbulence» is an important and very welcome event. Brenner’s essay brings to the fore once again the analysis of the economic crisis of the 1970s and 1980s, and argues that this economic crisis is not over yet. Therefore, there is still a great need to try to understand better the underlying causes of this continuing crisis and to have a public debate about the nature of these causes. The causes of the crisis determine the preconditions for recovery from the crisis and the likelihood of a full and lasting recovery in the years ahead. Brenner’s essay has once again put these questions squarely on the left agenda, and this is a significant contribution.

The publication of Robert Brenner’s «The Economics of Global Turbulence» is an important and very welcome event. Brenner’s essay brings to the fore once again the analysis of the economic crisis of the 1970s and 1980s, and argues that this economic crisis is not over yet. Therefore, there is still a great need to try to understand better the underlying causes of this continuing crisis and to have a public debate about the nature of these causes. The causes of the crisis determine the preconditions for recovery from the crisis and the likelihood of a full and lasting recovery in the years ahead. Brenner’s essay has once again put these questions squarely on the left agenda, and this is a significant contribution.

I also agree completely with Brenner’s emphasis on the rate of profit as the key explanatory variable in understanding the dynamics of capitalist economies in general and the causes of the economic crisis of the last 25 years in particular. Many radical economists, including myself, have placed a similar emphasis on the rate of profit as the key variable in explaining the current crisis. From this perspective, a significant decline in the rate of profit in all major capitalist countries in the 1960s and 1970s was the fundamental cause of both of the «twin evils» of higher unemployment and higher inflation that have afflicted these countries since the 1970s. As in business cycles of the past, the decline in the rate of profit resulted in a decline in business investment and higher rates of unemployment. One new factor in the postwar period has been that many governments in the 1970s responded to the higher unemployment by adopting Keynesian expansionary policies (more government spending, lower interest rates, etc.) in an attempt to reduce this unemployment. However, these government attempts to reduce unemployment generally resulted in higher rates of inflation, as capitalist enterprises responded to the government stimulation of demand by raising their prices at a faster rate in order to reverse the decline in their rate of profit. In the 1980s, financial capitalists revolted against these higher rates of inflation and have generally forced governments to adopt restrictive policies (less government spending, higher interest rates, etc.). The result has been less inflation, but also sharply higher unemployment and sharply reduced living standards. Therefore, government policies have affected the particular combination of unemployment and inflation that has occurred, but the fundamental cause of both of these «twin evils» has been the decline in the rate of profit. It is striking that mainstream economists have almost completely ignored the decline of the rate of profit in their explanations of the economic crisis of the 1970s and 1980s. Leer más…

«De crisis en crisis o la gran fortaleza del capital»: Sergio Cámara Izquierdo

Cómo caracterizaría la crisis capitalista actual? ¿se trata una crisis de nuevo tipo o más bien una fase de la crisis iniciada en 1973?

Cómo caracterizaría la crisis capitalista actual? ¿se trata una crisis de nuevo tipo o más bien una fase de la crisis iniciada en 1973?

SC: En el capitalismo existe una continuidad de los procesos económicos, pero se debe caracterizar no como una continuidad de la crisis de los setenta, sino como una nueva crisis estructural. La crisis de los setenta era una crisis estructural de rentabilidad asociada a la caída tendencial de la tasa de ganancia, que provocó un proceso de reestructuración de las condiciones generales de valorización del capital. Este proceso de reestructuración, que se conoce como neoliberalismo, puso en marcha los mecanismos necesarios para revertir la caída y recuperar la tasa general de ganancia. El neoliberalismo se caracteriza por un fuerte ataque a la clase trabajadora y el deterioro de las condiciones de reproducción de la fuerza de trabajo, por una globalización específica dada por la mayor movilidad de capitales de todo tipo –productivos, mercancías y dinero– a nivel internacional y por lo que se ha llamado financiarización o hegemonía financiera. Evidentemente, todos estos rasgos que han caracterizado a la economía en las últimas décadas, son consecuencia de la crisis estructural de la década de 1970, pero la nueva crisis estructural que estalla en 2008 en Estados Unidos (algunos incluso piensan que el punto de inflexión fue la anterior crisis cíclica en Estados Unidos en 2000-2001) es una crisis estructural nueva, distinta a la anterior. De hecho, es una crisis que podemos considerar de la reestructuración neoliberal, o la crisis del neoliberalismo. Leer más…

«Capitalism and Anwar Shaikh»: Michael Roberts

The most important book on capitalism this year will be Anwar Shaikh’s Capitalism – competition, conflict, crises.

The most important book on capitalism this year will be Anwar Shaikh’s Capitalism – competition, conflict, crises.

As one of the world’s leading economists who draws on Marx and the classical economists (‘political economy’, if you like), Anwar Shaikh has taught at The New School for Social Research for more than 30 years, authored three books and six-dozen articles. This is his most ambitious work. As Shaikh says, it is an attempt to derive economic theory from the real world and then apply it to real problems. Shaikh applies the categories and theory of classical economics to all the major economic issues, including those that are supposed to be the province of mainstream economics, like supply and demand, relative prices in goods and services, interest rates, financial asset prices and technological change.

Shaikh says that his “approach is very different from both orthodox economics and the dominant heterodox tradition.” He rejects the neoclassical approach that starts from “Perfect firms, perfect individuals, perfect knowledge, perfectly selfish behavior, rational expectations, etc.” and then “various imperfections are introduced into the story to justify individual observed patterns” although there “cannot be a general theory of imperfections”. Shaikh rejects that approach and instead starts with actual human behavior instead of the so-called “Economic Man”, and with the concept of ‘real competition’ rather than ‘perfect competition’. Chapters 3 and 7-8 emphasize that. It is the classical approach as opposed to the neoclassical one. Leer más…

“El capital: razón histórica, sujeto revolucionario y conciencia”: Juan Iñigo Carrera

Juan Iñigo Carrera, es economista e historiador de la Universidad de Buenos Aires, y director del Centro para la Investigación como Crítica Práctica (CICP). Entre el 5 y 12 de enero se encontrará en Chile, de forma inédita, impartiendo el seminario “El capital: razón histórica, sujeto revolucionario y conciencia” en la Universidad Academia de Humanismo Cristiano, en el marco de las “Jornadas de Crítica de la Economía Política. El Desarrollo Capitalista: Capital, Renta, Clases y Alternativa Política”, organizadas por CISOH. Leer más…

Juan Iñigo Carrera, es economista e historiador de la Universidad de Buenos Aires, y director del Centro para la Investigación como Crítica Práctica (CICP). Entre el 5 y 12 de enero se encontrará en Chile, de forma inédita, impartiendo el seminario “El capital: razón histórica, sujeto revolucionario y conciencia” en la Universidad Academia de Humanismo Cristiano, en el marco de las “Jornadas de Crítica de la Economía Política. El Desarrollo Capitalista: Capital, Renta, Clases y Alternativa Política”, organizadas por CISOH. Leer más…