The Henry George School of Social Science, and the New School of Social Research invite you to follow Professor Anwar M. Shaikh in a new series of lectures exploring his new ground-breaking Economic treatise, “Capitalism: Competition, Conflict and Crises”. The course will be introduced over two semesters. Recordings of the first semester, becoming available now, is comprised of 15 lectures. Subscribe to our YouTube Channel, Henry George School of Social Science to receive updates as new lectures are added.

The Henry George School of Social Science, and the New School of Social Research invite you to follow Professor Anwar M. Shaikh in a new series of lectures exploring his new ground-breaking Economic treatise, “Capitalism: Competition, Conflict and Crises”. The course will be introduced over two semesters. Recordings of the first semester, becoming available now, is comprised of 15 lectures. Subscribe to our YouTube Channel, Henry George School of Social Science to receive updates as new lectures are added.

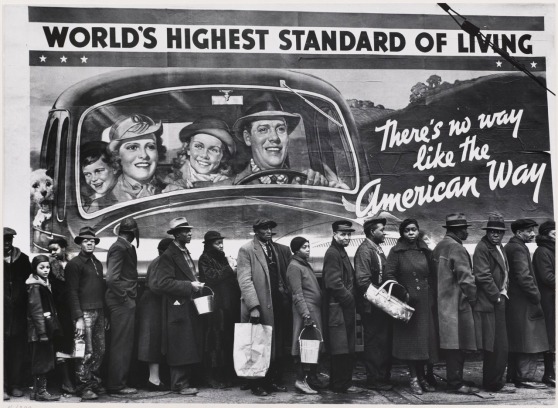

Competition and conflict are intrinsic features of modern societies, inequality is persistent, and booms and busts are recurrent outcomes throughout capitalist history. State intervention modifies these patterns, but does not abolish them.

Professor Shaikh exposes how these and many other observed patterns are the results of intrinsic forces that shape and channel outcomes. Social and institutional factors play an important role, but at the same time, the factors are themselves limited by the dominant forces arising from “gain-seeking” behavior, of which the profit motive is the most important. These dominant elements create an invisible force field that shapes and channels capitalist outcomes.

The book’s approach departs from that of orthodox economics as well as the dominant elements in the heterodox tradition. There is no reference whatsoever to an idealized framework rooted in perfect firms, perfect individuals, perfect knowledge, perfectly selfish behavior, rational expectations, or so-called optimal outcomes. The book develops microeconomic and macroeconomic theory from real behavior and real competition, and uses it to explain empirical patterns in microeconomic demand and supply, wage and profits, technological change, relative prices of goods and services, interest rates, bond and equity prices, exchange rates, patterns of international trade, growth, unemployment, inflation, national and personal inequality, and the recurrence of general crises such as the current one which began in 2007-2008.

Capítulo 6 de ‘Marx y la economía sin equilibrios’ editado por Freeman y Carchedi 1995 de la Editorial Edward Elgar.

Capítulo 6 de ‘Marx y la economía sin equilibrios’ editado por Freeman y Carchedi 1995 de la Editorial Edward Elgar.

Este artículo es la segunda parte de una crítica de Andrew Kliman a un

Este artículo es la segunda parte de una crítica de Andrew Kliman a un

Fred Moseley acaba de publicar un importante libro, Money and Totality. A Macro-Monetary Interpretation of Marx’s Logic in Capital and the End of the “Transformation Problem”, (Leiden, Brill, Historical Materialism Book Series). El libro ha sido editado en tapa dura por Brill (

Fred Moseley acaba de publicar un importante libro, Money and Totality. A Macro-Monetary Interpretation of Marx’s Logic in Capital and the End of the “Transformation Problem”, (Leiden, Brill, Historical Materialism Book Series). El libro ha sido editado en tapa dura por Brill ( Resumen

Resumen Gracias a los esfuerzos de marxistas a lo largo de todo el mundo, progresivamente tenemos a nuestra disposición, más obras de Marx traducidas en diferentes idiomas para su consulta. Recientemente, gracias a la editorial Brill y a la Revista

Gracias a los esfuerzos de marxistas a lo largo de todo el mundo, progresivamente tenemos a nuestra disposición, más obras de Marx traducidas en diferentes idiomas para su consulta. Recientemente, gracias a la editorial Brill y a la Revista  Existen dos vertientes generales dentro de la teoría económica marxista por la manera en que determinan los conceptos más relevantes (el valor, los precios, la tasa de ganancia, etc.): la simultaneista y la temporalista.

Existen dos vertientes generales dentro de la teoría económica marxista por la manera en que determinan los conceptos más relevantes (el valor, los precios, la tasa de ganancia, etc.): la simultaneista y la temporalista.