Archivo

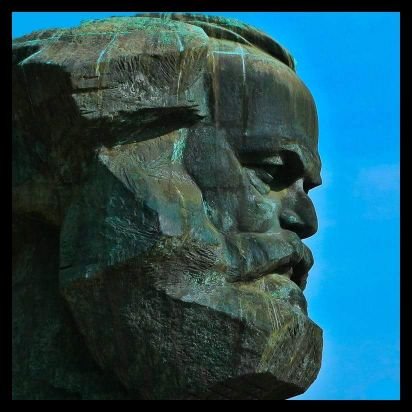

«The political economy of the dead: Marx’s vampires»: Mark Neocleous

Abstract: This article aims to show the importance of the vampire metaphor to Marx’s work. In so doing, it challenges previous attempts to explain Marx’s use of the metaphor with reference to literary style, nineteenth-century gothic or Enlightenment rationalism. Instead, the article accepts the widespread view linking the vampire to capital, but argues that Marx’s specific use of this link can be properly understood only in the context of his critique of political economy and, in particular, the political economy of the dead.

Abstract: This article aims to show the importance of the vampire metaphor to Marx’s work. In so doing, it challenges previous attempts to explain Marx’s use of the metaphor with reference to literary style, nineteenth-century gothic or Enlightenment rationalism. Instead, the article accepts the widespread view linking the vampire to capital, but argues that Marx’s specific use of this link can be properly understood only in the context of his critique of political economy and, in particular, the political economy of the dead.

Towards the end of Volume 1 of Capital, Marx employs one of his usual dramatic and rhetorical devices: ‘If money comes into the world with a congenital blood-stain on one cheek,’ he says, then ‘capital comes dripping from head to toe, from every pore, with blood and dirt’.2 The comment is a reminder of the extent to which the theme of blood and horror runs through the pages of Capital. According to Stanley Hyman, there are in Capital two forms of horror. The first concerns the bloody legislation against vagabondage, describing the way that agricultural peoples were driven from their homes, turned into vagabonds and then ‘whipped, branded, tortured by laws grotesquely terrible, into the discipline necessary for the wage system’. The second concerns the horrors experienced by people in the colonies, ‘the extirpation, enslavement and entombment in mines of the aboriginal population . . . the turning of Africa into a warren for the commercial hunting of black skins’.3 But to these we might add a third form of horror: the constant sucking of the blood of the Western working class by the bourgeois class. This form is nothing less than the horror of a property-owning class that appears to be vampire-like in its desire and ability to suck the life out of the working class.

«An Introduction to the Three Volumes of Karl Marx’s Capital»: Michael Heinrich

The global economic crisis and recession that began in 2008 had at least one unexpected outcome: a surge in sales of Karl Marx’s Capital. Although mainstream economists and commentators once dismissed Marx’s work as outmoded and flawed, some are begrudgingly acknowledging an analysis that sees capitalism as inherently unstable. And of course, there are those, like Michael Heinrich, who have seen the value of Marx all along, and are in a unique position to explain the intricacies of Marx’s thought.

The global economic crisis and recession that began in 2008 had at least one unexpected outcome: a surge in sales of Karl Marx’s Capital. Although mainstream economists and commentators once dismissed Marx’s work as outmoded and flawed, some are begrudgingly acknowledging an analysis that sees capitalism as inherently unstable. And of course, there are those, like Michael Heinrich, who have seen the value of Marx all along, and are in a unique position to explain the intricacies of Marx’s thought.

Heinrich’s modern interpretation of Capital is now available to English-speaking readers for the first time. It has gone through nine editions in Germany, is the standard work for Marxist study groups, and is used widely in German universities. The author systematically covers all three volumes of Capital and explains all the basic aspects of Marx’s critique of capitalism in a way that is clear and concise. He provides background information on the intellectual and political milieu in which Marx worked, and looks at crucial issues beyond the scope of Capital, such as class struggle, the relationship between capital and the state, accusations of historical determinism, and Marx’s understanding of communism. Uniquely, Heinrich emphasizes the monetary character of Marx’s work, in addition to the traditional emphasis on the labor theory of value, thus highlighting the relevance of Capital to the age of financial explosions and implosions.

“16 Tesis de Economía Política. Tesis III″: Enrique Dussel

«El ciclo equivalencial: valor de cambio, dinero y mercado«: tercera conferencia de Enrique Dussel sobre la crítica de la economía política de Marx de su curso ” 16 Tesis de Economía Política”

«El ciclo equivalencial: valor de cambio, dinero y mercado«: tercera conferencia de Enrique Dussel sobre la crítica de la economía política de Marx de su curso ” 16 Tesis de Economía Política”

«The Contradictions of Capital»: David Harvey

University of Warwick

University of Warwick

Distinguished Lecture Series

14 February 2013

David Harvey is the Distinguished Professor of Anthropology at the Graduate Center of the City University of New York. He is a leading political economist and social theorist of international standing. He is a highly cited academic and the author of many books and essays. Professor Harvey received his BA, MA and PhD from Cambridge University and was formerly Professor of Geography at John Hopkins University, Halford Mackinder Professor of Geography at the University of Oxford and Senior Research Fellow at St Peter’s College Oxford.

His numerous awards include Outstanding Contributor Award of the Association of American Geographers, the Centenary Medal from the Royal Scottish Geographical Society and the Patron’s Medal of the Royal Geographical Society for contributions to critical human

«Directly and Indirectly Social Labor: What Kind of Human Relations Can Transcend Capitalism?»: Peter Hudis

In exploring how to go “beyond capitalism,” we need to first ask why it has been so difficult to develop a comprehensive alternative to capitalism. One reason is the nature of capitalism, which creates the false impression that alienated human relations are natural and immutable. Capital’s ability to naturalize conditions of oppression is central to its ideological dominance. Another reason for the difficulty in envisioning an alternative is the failed attempts to emancipate humanity from capitalism. The failure of many revolutions to create a truly new society solidifies the view that there is no alternative to being subordinated to social laws outside our control. And there is yet a third reason that it has been hard to develop an alternative—the decline of interest in Marx’s work over the past few decades. Marx was not just one of many important thinkers. Marx was the founder of a unique philosophy of revolution that contained a specific concept of a new society. The less direct study and discussion there is of Marx’s works, the harder it becomes to envision an alternative to capitalism itself.

In exploring how to go “beyond capitalism,” we need to first ask why it has been so difficult to develop a comprehensive alternative to capitalism. One reason is the nature of capitalism, which creates the false impression that alienated human relations are natural and immutable. Capital’s ability to naturalize conditions of oppression is central to its ideological dominance. Another reason for the difficulty in envisioning an alternative is the failed attempts to emancipate humanity from capitalism. The failure of many revolutions to create a truly new society solidifies the view that there is no alternative to being subordinated to social laws outside our control. And there is yet a third reason that it has been hard to develop an alternative—the decline of interest in Marx’s work over the past few decades. Marx was not just one of many important thinkers. Marx was the founder of a unique philosophy of revolution that contained a specific concept of a new society. The less direct study and discussion there is of Marx’s works, the harder it becomes to envision an alternative to capitalism itself.

For this reason, we aim to seriously explore Marx. It will not do to focus on bits and pieces of his work that may or may not be to our liking. We instead have to grapple with his ideas as a whole. But grappling with his ideas as a whole entails grappling with his ideas in their specificity. Without doing so it is not possible to grasp Marx’s ideas at all. So let’s take a closer look at the work that contains Marx’s most detailed discussion of a non-capitalist society—his 1875 Critique of the Gotha Program.

“16 Tesis de Economía Política. Tesis II″: Enrique Dussel

«El ciclo productivo, trabajo vivo y valor» segunda conferencia de Enrique Dussel sobre la crítica de la economía política de Marx de su curso ” 16 Tesis de Economía Política”

«El ciclo productivo, trabajo vivo y valor» segunda conferencia de Enrique Dussel sobre la crítica de la economía política de Marx de su curso ” 16 Tesis de Economía Política”

«The Current Financial Crisis and the Future of Global Capitalism»: Michael Heinrich

Prophecies of Downfall

Prophecies of Downfall

The fact that Marx finally began with the composition of his long-planned economic work in the winter of 1857/1858 was directly occasioned by the economic crisis that broke out in the autumn of 1857 and the concomitant expectations of a deep trauma from which capitalism would no longer recover. «I am working like mad all night and every night collating my economic studies so that I at least get the outlines clear before the deluge,» wrote Marx to Engels in a letter from December of 1857 (MECW 40, p.217). The crisis of 1857/1858 was in fact the first true global economic crisis of modern capitalism, which involved all major capitalist countries of that time (England, the USA, France, and Germany). In the Grundrisse that emerged during this period, one can find the sole unambiguous passage of Marx’s work that can be understood as a theory of capitalist collapse (MECW 29, p.90 et sqq.). This collapse, Marx was convinced, would unleash revolutionary movements. In a letter to Ferdinand Lassalle from February of 1858, he even expressed his fear that in light of the expected «turbulent movements» his work would be finished «too late» and thus «find the world no longer attentive to such subjects» (MECW 29, p. 271). Marx was right about the fact that he wouldn’t finish his work (the first volume of Capital was published nine years later), but this first global crisis of capitalism led neither to a collapse of capitalism nor to any sort of revolutionary movement. The crisis had already been overcome in the early summer of 1858, and the capitalist system even came out of it enormously strengthened. Marx learned a lesson: in capitalism, crises function as brutal acts of purification. The destruction wreaked by crises removes previous impediments to accumulation and frees up new possibilities for capitalist development.

«Finance and the realization problem in Rosa Luxemburg: a ‘circuitist’ reappraisal»: Riccardo Bellfiore and Marco Passarella

Article showing that Rosa Luxemburg’s analysis of capitalist accumulation is framed within a ‘circuitist’ macroeconomic reading of capitalism as a monetary production economy

Article showing that Rosa Luxemburg’s analysis of capitalist accumulation is framed within a ‘circuitist’ macroeconomic reading of capitalism as a monetary production economy

Introduction

The aim of this chapter is to show that Rosa Luxemburg’s analysis of capitalist accumulation is framed within a ‘circuitist’ macroeconomic reading of capitalism as a monetary production economy. The strengths and limits of her approach are to be found elsewhere than suggested by usual criticisms, especially those advocated by Marxist authors. Rosa Luxemburg cannot be reduced to the uncertain theoretical status of an ‘under-consumptionist’. On the contrary, she presents a clear (although incomplete) picture of the macro-monetary and sequential working of the capitalist process.

This chapter is organized as follows. The next section examines Luxemburg’s comments on how the enlarged reproduction scheme is introduced in volume II of Marx’s Capital. The third, fourth, and fifth sections summarize, first, the orthodox attack by Bukharin, and then the more sympathetic interpretations provided by Michał Kalecki and Joan Robinson. The sixth and seventh sections emphasize the affinities and differences of Luxemburg’s circuitist perspective with the contemporary theory of the monetary circuit. The eighth section concentrates on the problem of the monetization of profits and interests. Some concluding remarks are provided in the last section.

«O novo padrão da dependência: a América Latina e o Brasil na actual divisão internacional do trabalho»: Jaime Osorio, Marcelo Dias Carcanholo e Mathias Seibel Luce

Seminário:

A TEORIA MARXISTA DA DEPENDÊNCIA E O CAPITALISMO LATINO-AMERICANO NO SÉCULO XXI

Lançamento do livro Padrão de reprodução do capital: contribuições da Teoria Marxista da Dependência (Boitempo Editorial)

Organização:

Núcleo de História Econômica da Dependência Latino-Americana (HEDLA/UFRGS) e Boitempo Editorial

Mesa-redonda:

O novo padrão da dependência: a América Latina e o Brasil na atual divisão internacional do trabalho

«16 Tesis de Economía Política. Tesis 1»: Enrique Dussel

Primera conferencia de Enrique Dussel sobre la crítica de la economía política de Marx de su curso » 16 Tesis de Economía Política»

Primera conferencia de Enrique Dussel sobre la crítica de la economía política de Marx de su curso » 16 Tesis de Economía Política»

«La unidad mundial de la acumulación de capital en su forma nacional históricamente dominante en América Latina. Crítica de las teorías del desarrollo, de la dependencia y del imperialismo»: Juan Iñigo Carrera

La cuestión

La cuestión

El modo de producción capitalista es el modo históricamente específico de regirse el proceso de vida humana en el cual la capacidad para organizar el trabajo social se presenta como un atributo automático materializado en el producto de ese mismo trabajo. Esta relación social objetivada, el capital, pone entonces en marcha el trabajo social sin otro fin inmediato que el producir más de esa capacidad para organizar automáticamente el trabajo social objetivada en su producto, más de la misma relación social objetivada, más capital, o sea, capital acumulado. De este automatismo brota su potencia como forma históricamente específica de desarrollarse las fuerzas productivas materiales del trabajo social, pero también su limitación como tal y la necesidad que lleva en sí de superarse en su propio desarrollo.

Dada su necesidad de expandir la producción material como si esta expansión no llevara consigo la necesidad de límite alguno originado en la misma forma social que la rige, la unidad del proceso de acumulación de capital tiene un contenido necesariamente mundial.

Leer más…

«¿Podría Keynes poner fin a la crisis? Presentando el multiplicador marxista»: Guglielmo Carchedi

Para Marx, la causa inmediata de la crisis es la caída de la tasa media de ganancia (ARP). 1 Un número creciente de estudios han demostrado que esta tesis no sólo es lógicamente consistente, sino que también es apoyada por un material empírico sólido y en crecimiento. 2 Si la decreciente rentabilidad es la causa del desplome, el desplome sólo terminará si la rentabilidad de la economía, se embarca en una senda de crecimiento sostenido. Entonces, la pregunta pertinente es: ¿pueden las políticas keynesianas restaurar la rentabilidad de la economía? ¿Pueden poner fin al desplome?

Para Marx, la causa inmediata de la crisis es la caída de la tasa media de ganancia (ARP). 1 Un número creciente de estudios han demostrado que esta tesis no sólo es lógicamente consistente, sino que también es apoyada por un material empírico sólido y en crecimiento. 2 Si la decreciente rentabilidad es la causa del desplome, el desplome sólo terminará si la rentabilidad de la economía, se embarca en una senda de crecimiento sostenido. Entonces, la pregunta pertinente es: ¿pueden las políticas keynesianas restaurar la rentabilidad de la economía? ¿Pueden poner fin al desplome?Leer más…

«Could Keynes end the slump? Introducing the Marxist multiplier»: Guglielmo Carchedi

For Marx, the proximate cause of crises is the fall in the average rate of profit (ARP).1 An increasing number of studies has shown that this thesis not only is logically consistent but is also supported by a robust and growing empirical material.2 If falling profitability is the cause of the slump, the slump will end only if the economy’s profitability sets off on a path of sustained growth. Then the relevant question is: can Keynesian policies restore the economy’s profitability? Can they end the slump?

To begin with, what are Keynesian policies? First, they are state–induced economic policies. Second, they can be redistribution policies or investments policies. Third, they should be capital financed and not labour financed. If labour-financed, they are neoliberal policies. Fourth, in the case of state-induced investment policies, they can be either civilian (mainly in public works like highways, schools, hospitals, etc, in order to avoid competition with those private sectors already experiencing economic difficulties) or military. I shall not deal with “military Keynesianism” because presently this is not what Keynesian economists propose to end the crisis. Some might think that a major war might be the only way out of the depression. This is an open admission of the monstrosity of this system. But then why save it? Then what follows refers only to civilian Keynesian policies.

Leer más…

«Statistical Evidence of Falling Profits as Cause of Recession»: J. A. Tapia Granados

Tapia Granados, José A. “ Statistical Evidence of Falling Profits as Cause of Recession A Short Note”, Review of Radical Political Economics December 2012 vol. 44 no. 4 484-493.

Tapia Granados, José A. “ Statistical Evidence of Falling Profits as Cause of Recession A Short Note”, Review of Radical Political Economics December 2012 vol. 44 no. 4 484-493.

Data on 251 quarters of the U.S. economy show that recessions are preceded by declines in profits. Profits stop growing and start falling four or five quarters before a recession. They strongly recover immediately after the recession. Since investment is to a large extent determined by profitability and investment is a major component of demand, the fall in profits leading to a fall in investment, in turn leading to a fall in demand, seems to be a basic mechanism in the causation of recessions.

«La disminución de la participación de los salarios en el origen de la crisis»: Michel Husson

La política de “devaluación interna”, es decir, la austeridad salarial se presenta actualmente como un medio para reducir los desequilibrios intra-europeos y superar la crisis. De esta manera se culpa implícitamente a los salarios de ser los responsables de la crisis. Lo que defiendo aquí es justamente el punto de vista contrario: la disminución general de la participación de los salarios (en el valor añadido) está en el origen de la crisis actual, en la medida en que se acompaña de tendencias insostenibles. Una vez establecido el hecho de esa disminución de los salarios y su mecanismos, el artículo propone un esquema general de interpretación del modelo neoliberal. Y termina con un enfoque más prospectivo, haciendo hincapié en el impasse al que conduce el ajuste salarial.

La política de “devaluación interna”, es decir, la austeridad salarial se presenta actualmente como un medio para reducir los desequilibrios intra-europeos y superar la crisis. De esta manera se culpa implícitamente a los salarios de ser los responsables de la crisis. Lo que defiendo aquí es justamente el punto de vista contrario: la disminución general de la participación de los salarios (en el valor añadido) está en el origen de la crisis actual, en la medida en que se acompaña de tendencias insostenibles. Una vez establecido el hecho de esa disminución de los salarios y su mecanismos, el artículo propone un esquema general de interpretación del modelo neoliberal. Y termina con un enfoque más prospectivo, haciendo hincapié en el impasse al que conduce el ajuste salarial.

Los hechos

Todos los estudios recientes de organizaciones internacionales como la OCDE, el FMI y la Comisión Europea coinciden en la disminución general de la participación de los salarios en el valor agregado. La contribución más reciente es la de la OCDE que se plantea en su último Panorama del Empleo los motivos de la “participación cada vez menor del trabajo” (OCDE, 2012).