Archivo

«Superexplotación de la fuerza de trabajo y Capital Financiero»: Marcelo Carcanholo y Juan Kornblihtt

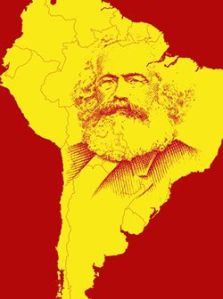

O IELA (Instituto de Estudos Latino-Americanos), divulgou na última semana a programação da X Jornadas Bolivarianas, que acontecerão entre os dias 9 e 11 de Abril no Auditório da Reitoria da UFSC, em Florianópolis. O Tema desta edição é “América Latina e os 40 anos da Teoria da Dependência”, e a programação trará importantes nomes do pensamento crítico latino-americano vinculados à teoria da dependência. Paralelamente, segue aberta até o dia 2 de Março a chamada pública para apresentação de trabalhos durante as X Jornadas Bolivarianas.

O IELA (Instituto de Estudos Latino-Americanos), divulgou na última semana a programação da X Jornadas Bolivarianas, que acontecerão entre os dias 9 e 11 de Abril no Auditório da Reitoria da UFSC, em Florianópolis. O Tema desta edição é “América Latina e os 40 anos da Teoria da Dependência”, e a programação trará importantes nomes do pensamento crítico latino-americano vinculados à teoria da dependência. Paralelamente, segue aberta até o dia 2 de Março a chamada pública para apresentação de trabalhos durante as X Jornadas Bolivarianas.

«La crise de 2008, une crise du néolibéralisme ? Une typologie des interprétations marxistes»: Jordi Brahamcha-Marin

Si depuis 2008 l’on ne cesse de proclamer le « Retour de Marx », c’est sans doute aussi parce que la crise de 2008 se prête particulièrement bien à une lecture marxiste. Rien de surprenant donc qu’on ait vu se multiplier les explications de la crise venant de penseurs se réclamant de Marx – témoins, par ailleurs, de la vitalité de ce courant de pensée. Jordi Brahamcha-Marin propose ici un premier panorama en langue française de ces différentes explications et des débats intenses qu’elles ont suscités.

Si depuis 2008 l’on ne cesse de proclamer le « Retour de Marx », c’est sans doute aussi parce que la crise de 2008 se prête particulièrement bien à une lecture marxiste. Rien de surprenant donc qu’on ait vu se multiplier les explications de la crise venant de penseurs se réclamant de Marx – témoins, par ailleurs, de la vitalité de ce courant de pensée. Jordi Brahamcha-Marin propose ici un premier panorama en langue française de ces différentes explications et des débats intenses qu’elles ont suscités.

Ce texte reprend une intervention faite au séminaire « Lectures de Marx » à l’ENS ( http://adlc.hypotheses.org/seminaires/seminaire-lectures-de-marx-a-lens-5e-annee) le 14 avril 2014. Il est suivi d’un tableau synthétique résumant les positions des différents auteurs évoqués.

La crise qui éclate en 2008 est, de l’avis unanime, la plus grave depuis 1929 : rien d’étonnant, dès lors, à ce qu’elle ait suscité une littérature abondante parmi les auteurs se réclamant du marxisme. Si quelques auteurs ont déjà proposé, en anglais, de brefs panoramas des interprétations marxistes de la crise,1 rien de tel, semble-t-il, n’existe en français. L’objet de cet article est de combler partiellement cette lacune, en proposant, sans prétendre à une inatteignable exhaustivité, un tableau d’ensemble des diverses contributions sur la question. Leer más…

«Profiting Without Producing: How Finance Exploits Us All»: A lecture by Costas Lapavitsas

The lecture by Costas Lapavitsas, Professor of Economics at the School of Oriental and African Studies, University of London celebrates the release by Verso Press of Profiting Without Producing: How Finance Exploits Us All. Lapavitsas explores the roots of the recent economic crisis in terms of «financialization,» the most salient feature of which is the rise of financial profit, in part extracted directly from households through financial expropriation, and discusses the options available for controlling finance and resolutions to the current crisis.

The lecture by Costas Lapavitsas, Professor of Economics at the School of Oriental and African Studies, University of London celebrates the release by Verso Press of Profiting Without Producing: How Finance Exploits Us All. Lapavitsas explores the roots of the recent economic crisis in terms of «financialization,» the most salient feature of which is the rise of financial profit, in part extracted directly from households through financial expropriation, and discusses the options available for controlling finance and resolutions to the current crisis.

Leer más…

«Financial times»: Joseph Choonara – A review of Costas Lapavitsas, Profiting Without Producing: How Finance Exploits Us All –

Profiting Without Producing: How Finance Exploits Us All (Verso, 2013), £20

Profiting Without Producing: How Finance Exploits Us All (Verso, 2013), £20

In the substantial body of Marxist literature emerging in the wake of the economic crisis that began in 2007-8, two broad positions have been evident.1 The first emphasises that the crisis erupted as a result of long-term tendencies within the capitalist process of production, generally focusing on a decline in the rate of profit in the post-war decades that has not subsequently been fully reversed. Exponents of this position include Robert Brenner and Anwar Shaikh, along with various writers who have been published in this journal, notably Michael Roberts, Guglielmo Carchedi, Andrew Kliman and Chris Harman.2 The second position concentrates on the specifically financial dimension of the crisis and typically downplays the tendency for the rate of profit to decline. The work under review confirms its author, Costas Lapavitsas, as one of the most important and intellectually sophisticated representatives of this position.

Of course, the two positions cannot be neatly disentangled. All of those mentioned above who fall into the first camp have been forced to grapple with the undeniable financial aspect of the crisis. Lapavitsas, too, is at pains to point out that finance cannot be understood without tracing its origins in wider processes within the capitalist economy. It is neither entirely autonomous of production, nor is it a parasitic outgrowth feeding upon it. Leer más…

«Concentración de capital bancario y la Necesidad de Nacionalizar la banca en Venezuela»: Jhon Caicedo

“Cuando el dinero funciona como medio de pago, supone operaciones de contabilidad, actos de compensación. Este trabajo es un gasto de circulación, no un trabajo creador de valor.”[i]

“Cuando el dinero funciona como medio de pago, supone operaciones de contabilidad, actos de compensación. Este trabajo es un gasto de circulación, no un trabajo creador de valor.”[i]

Karl Marx

“El dinero representa a todas las modalidades concretas del trabajo social y, por lo tanto, es en sí mismo la capacidad latente para poner en marcha a todas esas modalidades como punto de partida del proceso de metabolismo social.”[ii]

Juan Iñigo Carrera

No hay mejor situación en una revolución (claro, si es verdadera) que empezar estatizando la banca, realizarlo es vital. Catorce años (14) han transcurrido de proceso bolivariano y, tantos han sido los desatinos en política económica, es decir, comercial, monetaria, cambiaria, fiscal y sectorial y, hasta el presente es imposible entender: ¿Por qué no se ha optado por la Nacionalización de la Banca? De la totalidad de nuestro sistema bancario, o sea, (de 36 bancos, entre ellos bancos universales, comerciales, de desarrollo y de leyes especiales),sólo tres (3) bancos privados absorben el 40% de las captaciones del público ─incluidas las captaciones oficiales del gobierno─,es decir, que el 60% se reparte en un numeroso grupo de 33 bancos, de los cuales serían para cada banco en promedio el 1,81% en captación, pero eso no es todo, dichos bancos privados que se mencionan arriba, también calan en el liderato de cuotas de mercados, o sea, en: activos, en cartera de créditos, y en patrimonio[iii], y el elemento más significativo; el reporte de las ganancias más lucrativas que pueda generar dicho sector aunado de microscópicos impuestos a pagar, ni más ni menos, esto demuestra que la bicoca se sigue quedando en manos de banqueros privados.

«De la industrialización a la financiarización: auge y crisis del capitalismo en España (1959-2012)»: Matari Pierre Manigat

Resumen: La violencia de la crisis en España convoca a reflexionar sobre su trayectoria histórica durante los últimos decenios. Fue a partir de los años de 1960 que despegó el moderno capitalismo español después de un periodo de autarquía y lento crecimiento de la economía en la posguerra. Mientras el Estado rigió un intenso proceso de industrialización hasta la década de los setenta, la des-industrializacion y la financiarización constituyeron dos tendencias sobresalientes del periodo neoliberal. Analizamos la transición de un régimen de acumulación a otro considerando la transformación de la política económica del mercado laboral, del modo de gestión de las empresas y del sector financiero. La nueva articulación de estos elementos determinó la dinámica que arrastró la economía española hacia el desplome de 2008. Si bien se inscribe en el contexto de la crisis mundial, la coyuntura española haya su singularidad en el compromiso de la banca en la desenfrenada especulación sobre la renta del suelo. La creciente presión de las Bolsas sobre el Estado a partir de 2010 pone en relieve dos tipos de apuestas. La primera atañe, a corto plazo, al papel del Estado como rescatista de la banca cuyos capitales se desvalorizaron con el pinchazo de las burbujas financiera e inmobiliaria. La segunda atañe, a mediano y largo plazo, a la gestión de las enormes capacidades de producción excedentarias en la zona euro. Mostramos cómo la crisis en España pone de manifiesto el rol del capital financiero como impulsor de las purgas que requiere las condiciones de valorización del capital de las grandes corporaciones monopolistas en el periodo neoliberal.

Resumen: La violencia de la crisis en España convoca a reflexionar sobre su trayectoria histórica durante los últimos decenios. Fue a partir de los años de 1960 que despegó el moderno capitalismo español después de un periodo de autarquía y lento crecimiento de la economía en la posguerra. Mientras el Estado rigió un intenso proceso de industrialización hasta la década de los setenta, la des-industrializacion y la financiarización constituyeron dos tendencias sobresalientes del periodo neoliberal. Analizamos la transición de un régimen de acumulación a otro considerando la transformación de la política económica del mercado laboral, del modo de gestión de las empresas y del sector financiero. La nueva articulación de estos elementos determinó la dinámica que arrastró la economía española hacia el desplome de 2008. Si bien se inscribe en el contexto de la crisis mundial, la coyuntura española haya su singularidad en el compromiso de la banca en la desenfrenada especulación sobre la renta del suelo. La creciente presión de las Bolsas sobre el Estado a partir de 2010 pone en relieve dos tipos de apuestas. La primera atañe, a corto plazo, al papel del Estado como rescatista de la banca cuyos capitales se desvalorizaron con el pinchazo de las burbujas financiera e inmobiliaria. La segunda atañe, a mediano y largo plazo, a la gestión de las enormes capacidades de producción excedentarias en la zona euro. Mostramos cómo la crisis en España pone de manifiesto el rol del capital financiero como impulsor de las purgas que requiere las condiciones de valorización del capital de las grandes corporaciones monopolistas en el periodo neoliberal.

«The 17 Contradictions of Capitalism»: David Harvey at LSE

Speaker: Professor David Harvey

Speaker: Professor David Harvey

Chair: Dr Murray Low

Recorded on 2 April 2014 in Old Theatre, Old Building.

You thought capitalism was permanent? Think again. Leading Marxist thinker Professor David Harvey unravels the contradictions at the heart of capitalism — its drive, for example, to accumulate capital beyond the means of investing it.

David Harvey (@profdavidharvey) is Distinguished Professor of Anthropology and Geography at the Graduate Centre of the City University of New York. This event marks the publication of Professor Harvey’s new book, Seventeen Contradictions and the End of Capitalism.

Murray Low is associate professor of human geography in the Department of Geography & Environment at LSE. Leer más…

«Clarifying ‘Secular Stagnation’ and the Great Recession»: Andrew Kliman

In ‘Clarifying the Crisis,’ published earlier this year in Jacobin magazine, the Canadian political economist Sam Gindin reasserted his view that the global economic crisis that erupted in 2008 ‘needs to be understood primarily as a financial crisis.’ To be sure, the U.S. financial crisis was the event that triggered the Great Recession, and Gindin is certainly correct that the recession ‘turned into such a generalized and profound economic catastrophe’ largely because of the size of the financial sector, global financial integration, and the securitization of mortgage loans. Yet has one really ‘clarified the crisis’ by saying only this and then quickly moving on, as he does?

In ‘Clarifying the Crisis,’ published earlier this year in Jacobin magazine, the Canadian political economist Sam Gindin reasserted his view that the global economic crisis that erupted in 2008 ‘needs to be understood primarily as a financial crisis.’ To be sure, the U.S. financial crisis was the event that triggered the Great Recession, and Gindin is certainly correct that the recession ‘turned into such a generalized and profound economic catastrophe’ largely because of the size of the financial sector, global financial integration, and the securitization of mortgage loans. Yet has one really ‘clarified the crisis’ by saying only this and then quickly moving on, as he does?

In the U.S., the TARP bailout, ‘stress tests’ of financial institutions, and other actions succeeded in quelling the financial crisis by mid-2009 at latest. Yet it is now five years later, and the U.S. economy remains mired in a state of near-stagnation with no clear end in sight. Austerity policies are certainly not the culprit; U.S. fiscal and monetary policies have been wildly expansionary. The public debt has risen by 88% since the start of 2008; the extra $8.1 trillion of borrowing, which has been used for increased government spending and lower taxes, amounts to about $4400 per person per year for six straight years. The Federal Reserve has kept the federal funds rate (i.e. the overnight interbank interest rate) near zero for five full years and has bought $3.6 trillion worth of securities since Lehman Brothers collapsed in order to lower long-term rates. Nonetheless, near-stagnation persists–long after the financial crisis ended.

«La crisis global y el capital ficticio»: Consuelo Silva Flores y Claudio Lara Cortés. [Coordinadores]

Rosa María Marques. Paulo Nakatani. Reinaldo Carcanholo. Mauricio de Souza Sabadini. Claudio Lara Cortés. [Autores de Capítulo]

Rosa María Marques. Paulo Nakatani. Reinaldo Carcanholo. Mauricio de Souza Sabadini. Claudio Lara Cortés. [Autores de Capítulo]

…………………………………………………………………………

Colección Grupos de Trabajo.

ISBN 978-956-9372-03-2

ARCIS. CLACSO.

Santiago de Chile.

Diciembre de 2013

A la memoria de

Reinaldo Carcanholo,

colega, amigo y compañero de ruta.

Interview with Prof. David Harvey

Volume one, issue two of the Irish Left Review is now in stores – you can pick it up online or get it from one of the bookshops listed here. The latest issue features an extended interview with Marxist geographer and social theorist David Harvey. Professor Harvey is one of the best-known radical thinkers of the twenty-first century and has published popular books on topics ranging from urban rebellion to postmodernism and from Marx’s Capital to the history of neoliberalism.

Volume one, issue two of the Irish Left Review is now in stores – you can pick it up online or get it from one of the bookshops listed here. The latest issue features an extended interview with Marxist geographer and social theorist David Harvey. Professor Harvey is one of the best-known radical thinkers of the twenty-first century and has published popular books on topics ranging from urban rebellion to postmodernism and from Marx’s Capital to the history of neoliberalism.

In the printed interview he discusses his forthcoming book, ‘The Seventeen Contradictions of Capitalism’, illustrating how the emphasis on exchange value creates a crisis in housing and using contradiction as a basis to tease out a basis for postcapitalist imagination for the Left. Segments of that discussion have appeared previously in Red Pepper.

Below we print unpublished segments of the interview, conducted by journalists Ronan Burtenshaw and Aubrey Robinson, in which Professor Harvey discusses a variety of topics related to his own work and the politics of austerity Ireland.

«Speaking in Salvador, Brazil on Marx’s Capital, Volume I»: David Harvey

O Geógrafo David Harvey esteve em Salvador para apresentar a conferência «Para entender ‘O capital'», por ocasião do lançamento de seu livro homônimo.

O Geógrafo David Harvey esteve em Salvador para apresentar a conferência «Para entender ‘O capital'», por ocasião do lançamento de seu livro homônimo.

O evento integra o projeto «Marx: a criação destruidora», organizado em torno da publicação da edição definitiva de «O capital, Livro 1», pela Boitempo Editorial.

A conferência, ocorrida no dia 26 de março de 2013 no salão nobre da Universidade Federal da Bahia, teve realização da Boitempo Editorial e do Café Científico UFBA com apoio da Pró-Reitoria de Extnesão Universitária (PROEXT) e da Livraria LDM Multicampi.

«Social Capital And Capitalist Economies»: Ben Fine and Costas Lapavitsas

Abstract

The concept of social capital has become very influential in social science and is also increasingly deployed in analysis of transition economies. Its appeal derives from the attempt to relate the functioning of the capitalist economy to the non-economic relations of capitalist society. This article finds that the concept of social capital is inadequate for this purpose. By tracing the intellectual history of social capital, it is shown that the concept contains confusion with regard to both capital as economic phenomenon and capitalist social relations. Social capital conflates economy and society and hinders, rather than facilitates, analysis of capitalist society.

Keywords: social capital, social networks, post-Washington Consensus, World

Bank

«Teoria do Valor Trabalho e Crise»: Ricardo Antunes

Teoria do Valor Trabalho e Crise

Teoria do Valor Trabalho e Crise

Prof. Dr. Ricardo Antunes

Palestra proferida na UnB dia 19 de outubro de 2012, no período da tarde, na mesa redonda: Teoria do Valor Trabalho e Crise durante o I Encontro Internacional Teoria do Valor Trabalho e Ciências Sociais. Realização: Grupo de Estudos e Pesquisa sobre o Trabalho, Departamento de Sociologia/UnB.

«The Crisis, Five Years On»: Left Forum 2013 Panel on Crisis

Panel on ‘The Crisis, Five Years On‘ at Left Forum, New York June 2013. Organised by North Star. Three presenters: Doug Henwood, Radhika Desai, and Leo Panich, followed by discussion and responses from the presenters.

Panel on ‘The Crisis, Five Years On‘ at Left Forum, New York June 2013. Organised by North Star. Three presenters: Doug Henwood, Radhika Desai, and Leo Panich, followed by discussion and responses from the presenters.

«The profit rate in the presence of financial markets: a necessary correction»: Alan Freeman

In the past two decades the number, variety, and monetary value of marketable financial instruments, particularly securitized instruments, has grown by orders of magnitude. This is the most significant development in what many writers, for the most part Marxist, term ‘financialisation’1. It brings to light, however, an anomaly in the way they calculate the profit rate. This calculation takes no account of the capital tied up in these instruments.

This article shows that when this omission is corrected, there is a consistent long-run fall in the UK and US rate of profit which, contrary to the figures widely used by Marxists, have both fallen almost monotonically since 1968.

Why does this matter? First, the profit rate figures prominently in Marx’s own theory, as is clear from his published works. It is the explicit subject of the first 15 chapters of Capital Volume III (Marx, 1981: 117-378) and dominates the remaining analysis. Second, the results shed light on current debates about the cause of the present extended crisis. A significant group of writers (see Choonara, 2011) argue that this is recent in origin, unconnected with the serious difficulties that beset Western economies in the 1970s, and follows a recovery from that crisis, brought about by neoliberalism, in the 1980s. Thus Husson:

«After the generalized recessions of 1974-5 and 1980-82, a new phase opened in the functioning of capitalism, one which one could for convenience call neo-liberal. The beginning of the 1980s was a real turning point. A fundamental tendency towards increasing the rate of exploitation was unleashed, and that has led to a continuous rise in the rate of profit» (2008).

Leer más…